UNITED BENEFITS BLOG

Protecting your paycheck. Protecting your life. Protecting your retirement.

Government Shutdown FAQ

We're answering your questions. This FAQ is built from OPM's Guidance for Shutdown Furloughs as well as the questions you've asked us. Still have a...

Understanding the Medicare Extra Help Program for Part D

The Medicare Extra Help program was created to assist beneficiaries with the costs associated with prescription drug coverage, including premiums,...

Understanding Affordable Care Act Subsidies and How They Work

The Affordable Care Act (ACA) was established to provide access to healthcare for all individuals and to ensure that every plan covers essential...

The Importance of Preventative Care

The Importance of Preventative Care Most people only visit the doctor when they’re sick or injured, but preventative care is key to maintaining your...

Proposed Federal Benefits Cuts: Understanding Congress’s 2025 Proposals

Understanding Congress's 2025 Proposals Congress has passed a budget resolution directing the House Oversight and Government Reform Committee to cut...

What Is a Special Enrollment Period?

What Is a Special Enrollment Period? Normally, you can only make changes to your health insurance coverage during specific times of the year or...

Key Tax Law Changes for 2025: What Federal Employees Need to Know

As we enter 2025, there are several significant tax law changes that will impact individuals employed by the United States federal government. These...

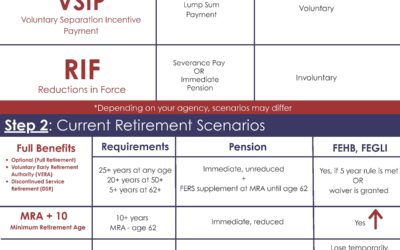

DRP, VSIP, RIF & Current Retirement Scenarios Chart

STEP 1: Determine Your Retirement Eligibility What is your Current Age and how many Years of Creditable Federal Service? (Check your Service...

Leaving Federal Service FAQ

We're answering your questions. This FAQ is built from the questions you've asked us - and we're updating it regularly to keep it helpful and...

Comparing Medicare Supplement Plans

Medicare Supplement Insurance plans, also known as Medigap plans, are designed to fill the "gaps" left behind by Original Medicare. These gaps...

Navigating a Reduction in Force (RIF): What Federal Employees Need to Know

In the Federal Government, layoffs are called reduction in force (RIF) actions. When an agency must abolish positions, the RIF regulations determine...

5 Things Every Federal Employee Should Know Before Separating from Service

Whether you accepted the deferred resignation offer, retire from federal service, or your position is ultimately eliminated, there are five things...

Subscribe to Updates

Subscribe to be notified about webinars, product updates, and in-person events.