Content adapted from material by Soeren Svendsen Annuity Reserve.

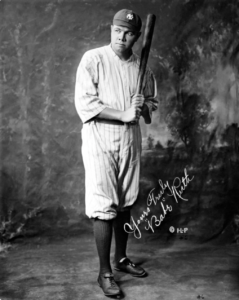

What do annuities have to do with the greatest major league baseball player of all time? The Babe took advantage of one of the greatest solutions to protecting retirement income – annuities.

In 1922, Babe Ruth was the highest-paid baseball player. He made a salary of $52,000 per year ($904,725 in 2022 dollars!) playing for the New York Yankees. The Babe spent the early part of the roaring 20s blowing through his tremendous salary. He was well on his way to going down in history as one of the many athletes who lived lavishly, spending recklessly towards bankruptcy.

In October 1923, at the urging of his business manager, Babe met with future Hall of Famer, Harry Heilman of the Detroit Tigers. Harry worked in the off-season as an insurance agent for The Equitable. With Harry’s guidance, Babe purchased an annuity with his World Series winnings and a portion of his annual salary. Throughout the next 7 years, Babe continued to make additional annuity purchases.

When Babe began making his annuity purchases, he had no idea that the roaring 20s would come to a crashing halt in October 1929 when the stock market crashed and the Great Depression began to take hold. Babe was forced to retire from baseball in 1935 since he could no longer stand the physical toll on his body. Once the highest-paid player in baseball, he found himself unemployed in the midst of the Great Depression.

Babe didn’t have to worry though – thanks to his previous planning with Harry Heilman, Babe was able to begin receiving payments of over $17,500 per year in annuity payments. $17,500 a year in 1934 is equivalent to $381,729 today. While other athletes and celebrities of the time found themselves in bread lines and destitute, The Babe lived comfortably in retirement and never had to worry about running out of money. The Babe was so impressed with the power of annuities in creating financial security that he directed his estate to purchase a lifetime payment annuity for his wife at the time of his death so that she would always be taken care of.

While Babe can’t teach us to hit home runs, he left behind a lesson in financial planning that we can all benefit from. By taking advantage of the protection of annuities you can retire knowing that you’ll never run out of money, no matter what happens in the stock markets.

Get in touch with a United Benefits Specialist to explore your options so you can relax and enjoy your retirement worry-free.