If your goal is to leave your TSP balance to your beneficiaries after you pass away you may be wondering how the Required Minimum Distribution affects their inheritance.

Once you reach the age of 72 and are separated from federal service, your Thrift Savings Plan account will start depleting due to the yearly Required Minimum Distribution (RMD). How much of your balance is available to leave to your loved ones will depend on how long you live.

The Internal Revenue Code (IRC) requires that you receive a portion of your TSP account each year starting the calendar year when you turn 72* years old and are separated from federal service. The portion is called a Required Minimum Distribution (RMD). Both Traditional and Roth are subject to a RMD. The TSP calculates the RMD amount using your age, your prior year-end account balance, and the IRS Uniform Lifetime Table (partial table shown below). These withdrawals will continue until the account balance is zero. For a traditional account, the RMD will be taxed but the RMD for a Roth account will not.

If you are looking for ways to leave this money to your beneficiaries after you pass away, there are options to meet your RMD amount that will give you guaranteed lifetime income that you can share with your family while you are alive. After you pass away, the remaining balance will go to your chosen beneficiaries. One such option is investing your RMD amount into a Fixed Index Annuity (FIA).

If you live a long life and deplete your TSP account balance, this guaranteed lifetime income will continue. It has the potential for steady growth (based on past performance) and will meet your Required Minimum Distribution obligations.

Receiving the RMD vs. Investing in a Fixed Index Annuity

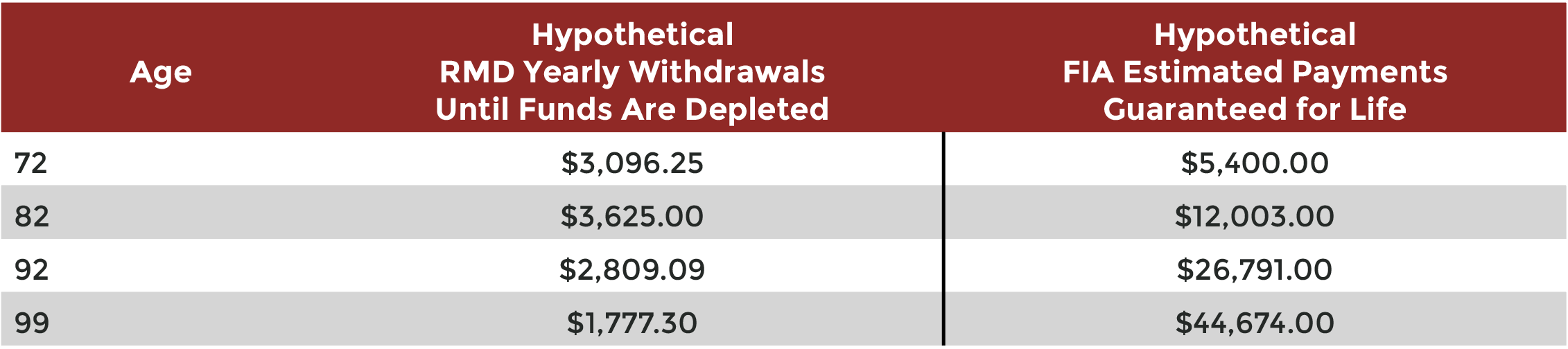

The following example is a hypothetical comparison of receiving the Required Minimum Distribution from the TSP each year vs. investing in a Fixed Index Annuity.

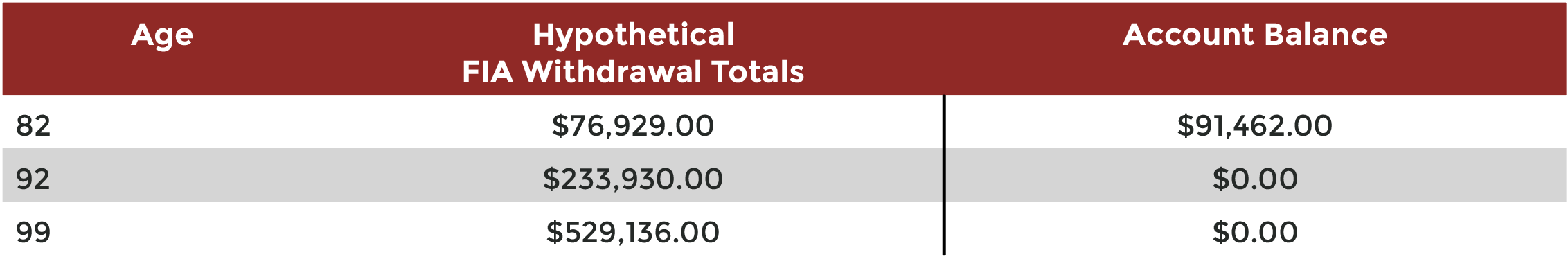

Bob has $100,000.00 in his TSP account and wants an estimate of what his yearly RMDs would be compared to moving the funds into a protected Fixed Indexed Annuity with guaranteed lifetime income. Both options will leave any remaining principle to Bob’s beneficiary after he passes away.

The comparison highlights that as Bob ages, his RMD withdrawals will become smaller and smaller while the FIA withdrawals will increase as long as the stock market they are indexed to increases. If the stock market loses money, not to worry – the withdrawal would remain the same. Since it’s a protected account, withdrawal amounts will never decrease.

With an investment of $100,00 Bob can continue to withdraw money every year from his FIA. At age 82, he will have withdrawn $76,929.00 in income and still has $91,462.00 in his account. When he’s 99, he will have withdrawn more than half of a million dollars. Impressive for an investment of $100,000.

Every situation is different. A United Benefits Specialist can help you determine the best option for you and your family. Fill out the form below to get in touch.