Social Security is a fundamental piece of your retirement income puzzle. It is a guaranteed lifetime payment, and one of three payments that make up your retirement income, along with your monthly annuity and your Thrift Savings Plan. Understanding how Social Security works and how to maximize it will ensure your income is adequate and protected throughout retirement.

When am I eligible to receive Social Security?

Social Security credits are the backbone of eligibility requirements for the program. The first step to understanding the Social Security system is to understand how to become eligible to receive benefits. There are three key qualifications that must be met in order to be eligible to receive Social Security benefits:

- Most people need 40 credits (10 years) of wages that were subject to Social Security payroll taxes

- Credits are cumulative and do not need to be consecutive

- Credits do not expire and will remain on the Social Security record

You can only earn up to 4 credits per year, so it will take 10 years to earn 40 credits. Earning credits is based on your income for the year. So while you can only earn up to 4 credits per year, your income may earn you 4 credits in a month or two.

How do I earn a Social Security credit?

The Social Security Administration makes adjustments to the amount of money you have to earn in wages, salary, or self-employment income in order to qualify to receive one Social Security credit. For 2021, the amount of earnings required will be $1,470. That’s up by $50 from the 2020 amount.

You can earn up to four Social Security credits each year. That means that you’ll max out your credits if you earn at least $5,880 in 2021. It makes no difference for your eligibility for Social Security whether you earn $6,000, $60,000, or $600,000 — you’ll still be limited to the same four-credit maximum.

How many Social Security credits do I need?

The number of credits you need depends on which benefit you want to claim. For retirement benefits, the rules are simple: You need 40 credits over the course of your work history. That equates to 10 years of work for most people who are able to earn the full four credits each year.

For disability benefits, the number of credits you need depends on your age. The following rules apply:

- 40 credits are always enough to qualify, regardless of age

- If you’re between 31 and 42 years old, you need 20 credits

- For every two years that you’re older than 42, you need two additional credits beyond 20

- Those between 24 and 31 need to have two credits per year since age 21

- Those younger than 24 need six credits over the preceding three years

Finally, for survivor benefits, 40 credits will always be enough for family members to qualify to receive Social Security. If you’ve earned six credits in the three years before your death, that also works, and family members of those who die at a relatively young age may require fewer than 40 credits.

When can I draw Social Security?

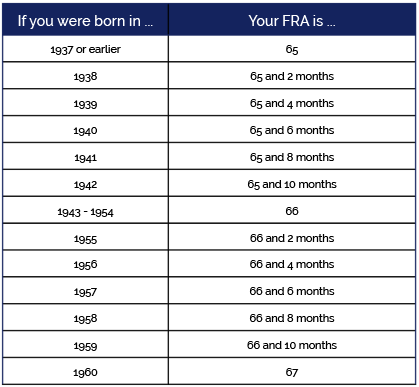

One of the first questions we get is often when you can draw Social Security. When you decide to draw Social Security will impact your benefit amount. The earliest you are able to draw Social Security is age 62. One of the exceptions is for widows and widowers, who are able to draw Social Security at the age of 60. However, if you draw Social Security at age 62 but have not yet reached your Full Retirement Age (FRA), also referred to as Normal Retirement Age, as determined by the year you were born, then your benefit may be reduced by up to 30%.

If you decide to start drawing Social Security at your Full Retirement Age, which is around age 65-67 for most federal employees, then you will receive your full Social Security benefit. See the chart below to find your Full Retirement Age.

If you decide to delay drawing Social Security, you can receive increases to your Social Security benefit. Deferral increases stop at age 70. You will receive the largest monthly benefit if you delay drawing Social Security, which is one strategy you can apply to maximize your benefits. Note: if you decide to delay filing for Social Security, be sure to still sign up for Medicare. If you do not sign up, in some circumstances your Medicare coverage may be delayed and cost more.

How are benefits impacted from taking Social Security early?

It’s important to understand the cost of filing for Social Security early before you reach your Full Retirement Age, especially if you are still working. Social Security withholds benefits if your earnings exceed a certain level, called a retirement earnings test exempt amount, and if you are under your FRA. One of two different exempt amounts applies — a lower amount in years before the year you attain FRA and a higher amount in the year you attain FRA.

- If you file before your FRA, you’ll be penalized for earning any money above a certain amount: as of 2021, that amount was $18,960. If you earn anything above that amount, your benefit will be reduced by $1 for every $2 you earn above the limit.

- If you decide to file in the year your FRA is reached, you will give up $1 in benefits for every $3 earned above a $50,520 limit.

- If you file for Social Security after your FRA, you will not incur any penalties.

How are benefits impacted from delaying Social Security?

If you delay filing for Social Security past your Full Retirement Age, you will receive a deferral increase to your monthly benefit based on the number of months you defer past your FRA.

For every month you postpone filing for benefits from your FRA until age 70, Social Security increases your eventual benefit by two-thirds of 1 percent, which is a total of 8 percent for each year you wait. For example, if you would reach FRA at age 67 but file for Social Security at age 70, you would get an extra 24 percent increase in your monthly benefit. You can file for Social Security after age 70, but the increases stop so waiting longer won’t increase your monthly benefit.

How do I decide when to draw Social Security?

Deciding when to draw Social Security is one of the few decisions you get to make about this piece of the retirement benefit puzzle. Social security is a guaranteed lifetime benefit, so the amount you pull out of Social Security is directly tied to how long you live.

This can impact your Social Security strategy by helping you decide when to draw Social Security. If you anticipate living a long life, you may want to delay drawing your Social Security. If you have health issues, it may not make as much sense to defer Social Security.

How is my amount of Social Security determined?

Your Social Security retirement benefit is based on your earnings that were eligible to be taxed. Higher-income translates to a bigger benefit (up to a point — more on that below). The amount you are entitled to is also modified by other factors, especially the age when you decide to start drawing Social Security.

Most people don’t know that Social Security has a maximum payable amount you are eligible to receive: you can look at it as a cap.

The most an individual who files a claim for Social Security retirement benefits in 2021 can receive per month is:

- $3,895 for someone who files at age 70

- $3,148 for someone who files at normal retirement

- $2,324 for someone who files at 62

For context, the estimated average Social Security retirement benefit in 2021 is $1,543 a month. The average disability benefit is $1,277.

A United Benefits Retirement Specialist can help you determine how much your monthly Social Security payment will be, or you can use our Social Security Estimation calculator.

How does being married affect my Social Security?

Anyone that was married for more than 10 years and has not remarried may be eligible to draw off of their ex-spouse’s Social Security.

If a spouse passes away, the widow or widower can decide to take their own Social Security or the spouse’s, whichever is higher.

How much is my Social Security taxed?

You may have to pay federal income taxes on your Social Security benefits if you have other substantial income, such as wages, self-employment, interest, dividends, and other taxable income.

Based on IRS rules, 15 percent of your Social Security benefit is passed to you as tax-free income. You may pay tax on up to 85 percent of your Social Security benefits. If you:

- file a federal tax return as an individual and your combined income is

- between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits.

- more than $34,000, up to 85 percent of your benefits may be taxable

- file a joint return, and you and your spouse have a combined income that is

- between $32,000 and $44,000, you may have to pay income tax on up to 50 percent of your benefits

- more than $44,000, up to 85 percent of your benefits may be taxable.

- are married and file a separate tax return, you probably will pay taxes on your benefits

The Retirement Benefits Puzzle

Are you confident in your plans to maximize Social Security? If you have questions regarding your Social Security benefits and how to maximize them in retirement, our Retirement Benefits Specialists are available to help. You can schedule a free one-on-one appointment to review your retirement benefits package. Our experts can help you calculate your FRA, determine your Social Security benefit, and discuss all of the factors that can impact them and the other pieces of your retirement puzzle. Fill out the form below to schedule an appointment.

*The Content is for informational purposes only, you should not consider this information or other material as legal, tax, investment, financial, or other advice.