When determining your FERS pension, you will need to calculate your High-3 Salary is a very important part of your FERS pension calculation. Your High-3 Salary is the highest average of BASIC pay you earned during any 3 consecutive years of Federal service.

Your High-3 Salary is not based on calendar years but on three consecutive years where you have earned the highest pay. Therefore, your High-3 years could be from March 2015 to March 2018. Most people do earn their highest pay during their last three years of service, but not always. Your High-3 years can be from an earlier time in your career. Be sure to review your entire earnings history to find the time period to use for your High-3 Salary.

Basic pay includes:

- Locality pay

- Salary for your position

- Night differential (for wage system only)

- Environmental differential pay

- Premium pay for stand-by time (applies to some firefighters)

- Law Enforcement Availability Pay (LEAP)

- Up to half annual overtime cap CBPOs

Basic pay does NOT include:

- Bonuses and/or cash rewards

- COLA – Cost of Living Adjustments

- Overtime pay

- Holiday and/or Sunday premium pay

- Military pay and/or supplement pay (OWCP)

- Foreign Post Differential

- Night differential for Non-Wage Grade Employees

Where Can I Find My Basic Pay?

Your Basic Pay is located on your Standard Form 50 (SF50). Basic Pay should be in block 20C – Adjusted Basic Pay.

Why Would I Need to Know My High-3 Salary?

You need to know your High-3 Salary to estimate your federal pension. You’ll need to know what your federal pension is going to be so you can plan your retirement and ensure you have enough money before retiring.

Another reason you need to know your High-3 Salary is that about 10-15% of federal retirement applications will have an error in processing. Depending on which agency submits the application to OPM, the error rates could be much higher.

You need to know your retirement numbers so that when you are ready to submit your retirement application, you will know whether or not you are receiving the correct amount.

For Federal Employees in Puerto Rico, Alaska, Hawaii, & Other U.S. Territories

Federal Employees living in Non-Foreign Areas like Alaska, Hawaii, and Puerto Rico, have mostly been transitioned from receiving COLAs to receiving Locality Pay.

Locality Pay is considered when calculating your High-3 Salary, but COLAs are not.

If you worked in an area with high Locality Pay, be sure to review your entire career before automatically assuming that your High-3 Salary will be your last three years of service.

More Detailed Calculations for Your High-3 Salary

If you are near your retirement date, you will want a more specific calculation of your High-3 Salary. You will need to gather your SF50s and get ready for some number crunching.

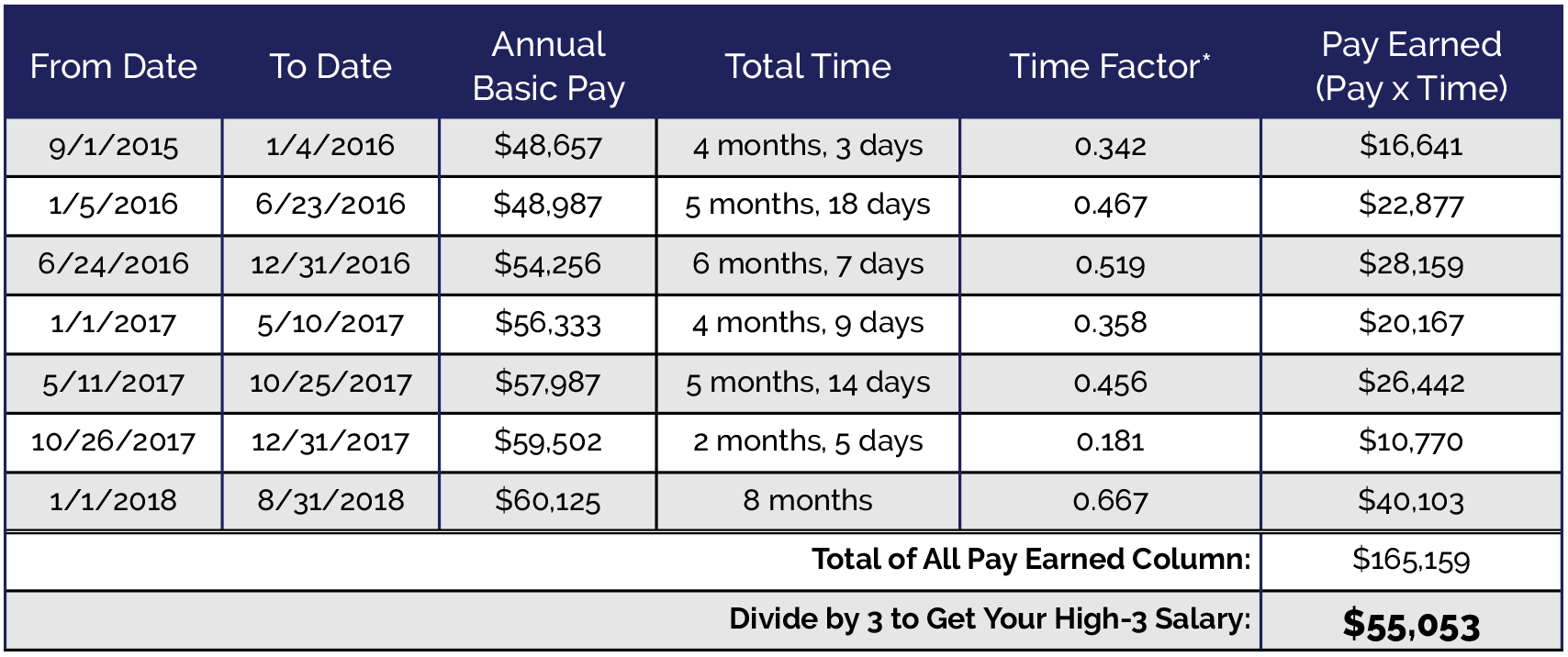

Since your pay has probably increased at odd times over the year – you’ll need to account for those times when calculating your High-3 Salary. Take a look at the example below.

Example High-3 Salary Calculation

In this example, the High-3 Salary time was from 9/1/2015 to 8/31/2018. As you can see their basic pay increased several different times during this period.

In the first row, from 9/1/2015 to 1/4/2016, the basic pay is $48,657.

Time Factor

There were four months and three days during the time between 9/1/2015 and 1/4/2016. The four months and three days works out to be 0.342 of a year.

We then multiply the basic pay of $48,657 x 0.342 to get $16,641. This is their actual basic pay earned during that time period.

We then will complete a row for every time they received an increase in basic pay.

Then we will add the last column to get their total amount of basic pay received during their highest three years. In the example, the number totals up to $165,159. We will then take that number and divide it by three to get their High-3 Salary of $55,053.

If you had several changes in your basic pay during your High-3 years, this method will help calculate your High-3 pay to use in your pension calculation. If there was another time in your career that had higher pay, use those 3 years instead.

Get Retirement Help from an Expert

Schedule your free one-on-one consultation with a United Benefits Specialist today. We’ll help you calculate your pension, determine your High-3 Salary, and explore retirement strategies to maximize your benefits. Use the form below to get in touch.