Are you taking advantage of Thrift Savings Plan matching?

For FERS employees, the matching inside the Thrift Savings Plan is the greatest advantage you have when building your balance. The agency will match a portion of your TSP contributions with the percentage varying based on how much you are contributing. Here are the basics of the TSP matching program:

How much money will the agency contribute to my Thrift Savings Plan?

The amount of money you contribute to your TSP balance will directly affect how much your agency will contribute. Keep in mind; the agency will not always match dollar-for-dollar. However, it is still important to know the ratio to get the most out of the matching plan.

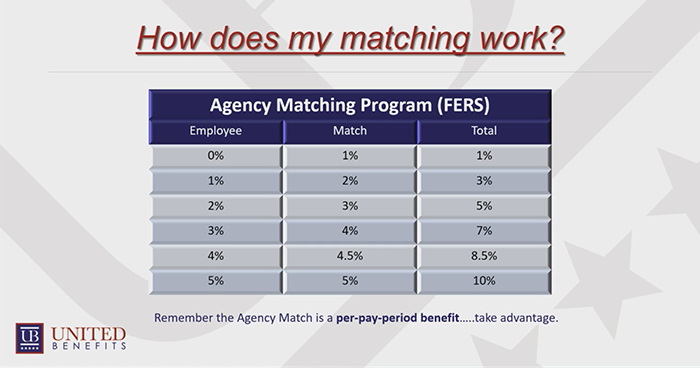

Below is an easy-to-follow chart demonstrating what the agency will match based on how much you contribute to your TSP.

With zero percent contributions, your agency will contribute the equivalent of 1% of your paycheck to your TSP automatically.

If you contribute between 1-3% of your paycheck, the agency will match every dollar you contribute – you’ll also get an additional 1% in matching. That means if you’re putting 3% of your paycheck regularly into your TSP, the agency will match an additional 4%. That’s a total of 7% going into your retirement funds!

If you decide to contribute 4%, the agency will contribute 4.5%. If you choose to contribute 5%, then they’ll match 5% dollar-for-dollar.

That means for the first 5% of your paycheck that you contribute, in addition to the agency matching of 5%, your total contribution will equal 10% of your pay. By fully taking advantage of the matching program, you can effectively double your savings rate.

Is there a contribution limit to my Thrift Savings Plan?

Yes, as of 2021, federal employees can contribute up to $19,500. However, if you’re older than 50, there’s a catch-up provision that allows you to contribute an extra $6,500 for a total of $26,000. (Remember, that’s your contributions, not the matching.)

You may need to be careful not to hit your limit early in the year. If you max out the contribution too early in the year, you will sacrifice the 5% matching opportunity for the remainder of the year.

Do the Agency matching contributions go to the Roth or Traditional TSP accounts?

The money contributed by the agency to your Thrift Savings Plan will always go into the Traditional TSP and not the Roth TSP. You are free to choose which you’ll contribute to or both, but it’s important to understand the differences between the Traditional and Roth TSP when making your decision.

Since the agency matching goes to the Traditional side of the TSP account, the contributions are made on a pre-tax basis. This means that the agency matching and the interest earned in this account will be subject to taxes when you withdraw.

In Conclusion

It is imperative to take advantage of the free matching available to them through their agency. This matching can drastically impact the total balance that you will be able to access into retirement from your TSP. If you have questions about your Thrift Savings Plan, contributions, or maximizing matching, United Benefits can help. Fill out the form below to get in touch.