You did it! You completed your federal career and have transitioned into retirement. A hearty congratulations are in order. You worked hard, and now a new journey begins. With that journey comes a few decisions about your benefits. The topics below cover the main questions that we receive from retirees.

Coordinating FEHB & Medicare

Once you are enrolled in Medicare, you’ll need to coordinate your benefits to make sure you have the coverage you want as efficiently as possible.

Medicare Enrollment Windows

Most people become eligible for Medicare at age 65. Your Medicare options will depend on whether you retire before or after becoming eligible.

If you retire before age 65, then on your 65th birthday you’ll need to make some decisions. You have 7 months to choose your Medicare options – three months prior to your birthday month, your birthday month, and three months after your birthday month. If you retire after you’re eligible for Medicare, you have an 8-month window to determine your Medicare options, starting on your retirement date. These windows are important because this is the only time you can make decisions about your Medicare without incurring penalties. Penalties are lifelong, so it’s very important to make these decisions in the right window of time.

FEHB

Your Federal Employees Health Benefits (FEHB) plan is healthcare insurance that you (and your spouse, if you have chosen that option) are eligible for. These plans vary depending on what you have selected. They all have a premium cost, most have a deductible, and then they may have copays or coinsurance.

Parts of Medicare

Medicare is made up of four different parts.

Part A covers hospital charges. If you have been working for most of your life, this is already paid for as you’ve been paying into the system. So, when you turn on Part A, there is generally no charge for the rest of your life.

Part B covers medical charges outside of a hospital, such as doctor visits, labs, testing, therapies, etc. There is generally a monthly charge for turning on Part B.

Part D covers prescription drugs. For those that have an FEHB plan, your prescription drugs are already covered under your health insurance plan and there is no need to turn on Part D of Medicare. For those that do not have an FEHB plan, it is mandatory to turn on Part D to have a prescription drug plan.

Part C is a private plan through an insurance company. It combines Part A, Part B, and Part D into an all-in-one plan. You may have also heard this called Medicare Advantage.

As a federal employee, do I need Part B?

This question is very important and needs to be answered within the Medicare enrollment window. When you are retired, Medicare is your primary insurance. So, if you go into the hospital, Medicare Part A will pay out, and then your FEHB plan. Having Medicare reduces your exposure to out-of-pocket costs.

Similarly, if you have medical expenses like a doctor’s visit and you have Medicare Part B, the doctor’s office will charge Medicare first and then your FEHB plan. If you do not have Medicare Part B, they will only charge your FEHB plan, which means you’ll have higher out-of-pocket costs.

As the market has changed, some Medicare Part C plans have started offering a rebate to pay for some or all of the Medicare Part B premium. That changes the scenario significantly. Now you could not only turn on Part B but also add an extra layer of security to reduce your out-of-pocket costs for treatments in and out of the hospital. Part C plans often offer additional benefits like dental and vision insurance. If you are a veteran, there are Part C plans with $0 premiums that are designed especially for you.

The decision to turn on Part B is a personal one that will consider your health, finances, risk tolerance, and more. You can schedule a free one-on-one consultation with a United Benefits Medicare Specialist to find the options that are right for you now and in the future.

Timing Social Security

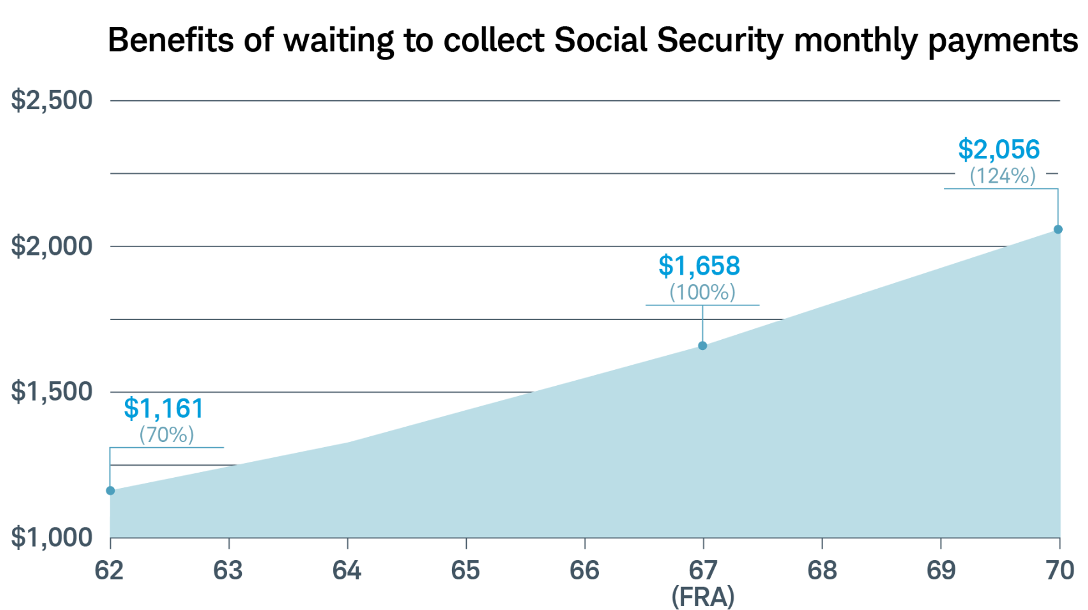

Deciding when to turn on social security is important because it can impact the amount of your social security payments. Whatever age you decide to turn on social security, it will stay that amount for the rest of your life. About 33% of 65-year-olds today will live until at least age 90, and about 1 in 7 will live until age 95. That makes the decision of when to turn on your social security payments extremely important.

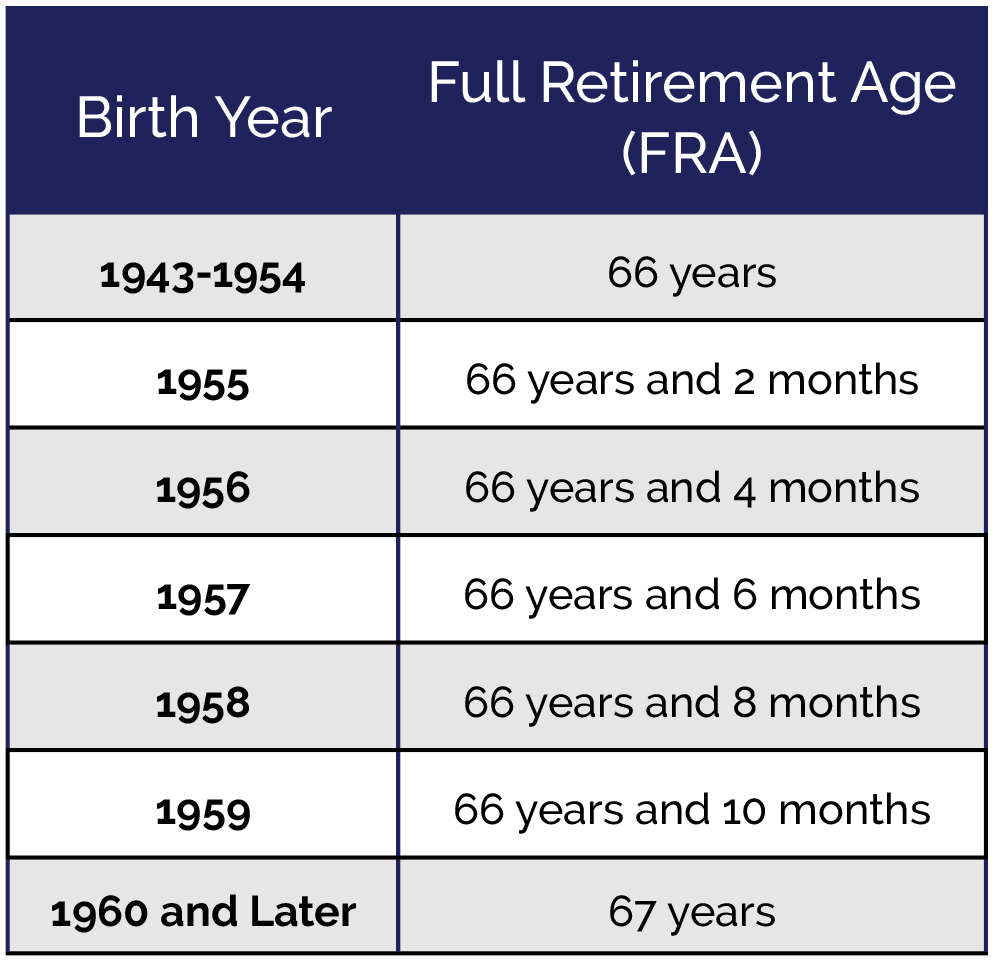

You can start receiving benefits as early as age 62 and as late as age 70. However, there is something called your Full Retirement Age (FRA). Your FRA is determined by your birth year.

If turn on your social security benefits and you are still earning income prior to the full retirement age, you have an earnings limit. If you earn more than that amount, you will be penalized $1 of your social security for every $2 beyond the earnings limit. In the example below, John is deciding when to turn on his social security payments. His FRA is 67. If he retires and gets a part-time job at age 62, he has an earnings limit AND his amount of social security is reduced. If John decides he’s going to wait to retire and push off turning on his social security payments until he turns 70, his social security payment is increased.

Thrift Savings Plan Withdrawals

After you retire, your Thrift Savings Plan (TSP) gives you about five withdrawal options. Each person has a different scenario – not every option will make sense for you, but there’s one that will. There’s also the possibility to utilize more than one option to maximize their money for retirement.

Single Payment: You take all your money out of your TSP. Taxes are taken out and you walk away with a lump sum.

TSP Monthly Payments: You receive monthly payments of an amount that you determine. Taxes are taken out and you receive a check. Once your TSP balance is depleted and your balance is zero, your account will be closed.

Annuitization: You can purchase an annuity. The annuity company promises to pay you a certain amount each month for the rest of your life. You forfeit access to your TSP balance in exchange for the lifelong monthly payment. You could also add beneficiary benefits to provide in the event you pass away or add an additional lifelong payment to a spouse. Both of these additional benefits will incur a fee, which will reduce your monthly income.

Required Minimum Distributions (RMDs): If you decide to leave your balance in the TSP, you will be subject to required minimum distributions (RMDs) starting at age 70.5 or age 72, depending on your birth year. That means that you’ll need to regularly take the minimum amount of money out of your account.

Transfer/Rollover: You take personal ownership of your TSP balance and move it into an Individual Retirement Account (IRA). You could then move the money into a protected IRA, which provides for lifetime income, chronic care, and beneficiary accounts.

How do I decide what to do with my TSP?

The best way to move money out of your TSP account will depend on your goal. Do you want the security of lifetime income? Do you want to ensure spousal support? For a lot of federal employees, their spouse does not have a pension so it’s important to ensure they are taken care of.

Do you want to leave a legacy and move money to the next generation? Pre-planning can help determine the most efficient way to transfer assets and ensure that your loved ones do not have the burden of final expenses.

How much risk do you want to tolerate? Generally, in retirement, people like to move to scenarios with less risk.

Do you want to be covered in the event of needing chronic care? 70% of people over 65 will require long-term care at some point in their lives. Only 10% of those have long-term care coverage. Long-term care can be very costly, so if it’s important to you to have a plan it’s good to talk about it before it becomes a necessity.

Wrapping Up

Every year you’ll have the opportunity to participate in open season for both FEHB and Medicare. Your needs will change as you age – maybe you move, or a situation changes. It’s a good idea to review your coverage regularly.

Know your options regarding your TSP – the things that are most important to you will help you decide how to handle your account.

Most of all, enjoy your retirement! You’ve worked hard and can now take a step back and enjoy what you’ve accomplished. United Benefits is always here to help even after you leave federal service. Use the form below to get in touch with a United Benefits Specialist.