Early Retirement, Deferred Retirement, Postponed Retirement, and Disability Retirement

Life happens – maybe you intended to be a federal employee only for a short time, or perhaps a life circumstance means that you need or want to leave federal employment before you reach retirement age. When that happens, how do you maximize your retirement benefits?

Federal employees that separate from federal service before they reach immediate full retirement may fall into another category:

- Early Retirement

- Deferred Retirement

- Postponed Retirement

- Disability Retirement

We’ll take a look at each of these scenarios and what eligibility requirements there are, as well as what retirement benefit penalties are incurred.

Early Retirement

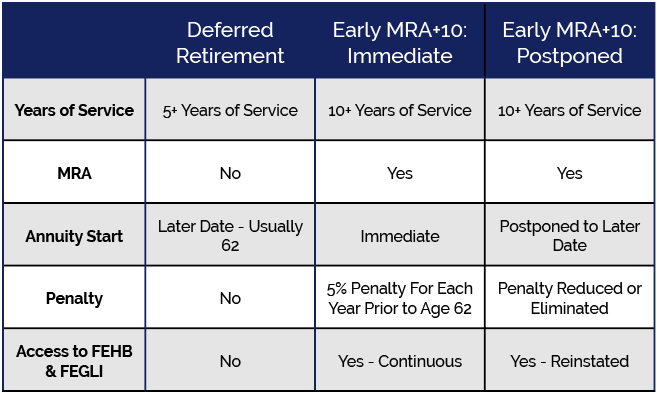

Early retirement may be an option if you want to retire now but don’t yet qualify for full retirement based on either your age or years of service. With early retirement, you start receiving your monthly annuity as soon as you retire. You will be able to keep your Federal Employee Health Benefits (FEHB) and Federal Employee Life Insurance (FEGLI). However, your monthly annuity is reduced – so you’ll need to weigh your options.

There are several types of early retirement, but the main one is MRA+10 Retirement, where you can retire at the Minimum Retirement Age (MRA) if you have 10 or more years of federal service. For this type of retirement, your annuity will be reduced for each month under age 62.

What’s my MRA?

Early Retirement Annuities

Under the early retirement annuity, the Office of Personnel Management (OPM) will calculate your Federal Employee Retirement System (FERS) annuity and reduce the benefit by 5% per year that you retire under the age of 62.

For example, if a 57-year-old retires early with 20 years of service, they would have hit their Minimum Retirement Age but not their required Years of Service. Therefore, OPM would reduce the retirement annuity by 25% of the FERS benefit.

The positive to early retirement is you are allowed to maintain your FEHB and FEGLI benefits possibly. In addition, there is no income means test associated with early retirement, so you could also work an additional job with no penalty. The negative is that you will not receive full benefits, and the reductions in benefits will be permanent. You will also be forfeiting the FERS supplement.

A United Benefits Retirement Specialist can help you calculate your monthly annuity based on your specific scenario depending on which provision you retire under. Use the form at the bottom of the page to schedule a one-on-one consultation.

Postponed Retirement

If you have reached your MRA before separation and have more than 10 years of service, you are eligible for a postponed retirement. This will allow you to resume your FEHB and FEGLI once you have met the requirements and start your retirement annuity. You may be able to eliminate specific retirement penalties if you postpone your retirement until the appropriate age.

Deferred Retirement

Deferred retirement is when you separate from federal service before you are eligible for full retirement but do not start drawing your pension until later.

The most important thing to know is that if you receive a deferred annuity, you are not eligible to continue Federal Employee Health Benefits (FEHB) or Federal Employee Group Life Insurance (FEGLI). In addition, if you receive a deferred annuity, you are not eligible for the retiree annuity supplement.

Deferred Retirement Eligibility

According to OPM

- “You have completed at least 5 years of creditable civilian service, then you are eligible for a deferred annuity beginning the first day of the month after you reach age 62

- You have completed at least 10 years of creditable service, including 5 years of civilian service. You are eligible for a deferred annuity beginning the first day of the month after you reach the Minimum Retirement Age (MRA)*.”

If you elect a deferred retirement, you forfeit your FEHB and FEGLI.

You will not receive a penalty in retirement benefits if you wait until you have the age and years of service to match. However, if you start your retirement before age 60 with less than 20 years of service or before age 62 with 5 years of service, you will receive the same reduction as early retirement of 5% per year before age 62.

Early vs. Deferred vs. Postponed Retirement

If you want to leave federal service before reaching full retirement age, you’ll need to decide if you are taking early retirement or a deferred retirement. That choice is personal, and the answer will depend on your specific situation. A United Benefits Retirement Specialist can help you outline the options.

FERS Disability Retirement

FERS Disability Retirement is precisely what it sounds like – A federal employee may apply for disability retirement if they have a medical condition that prevents them from performing their job and their agency has exhausted all reasonable attempts to keep the employee productive through accommodation or reassignment.

This is different from Social Security Disability. While qualifying for Social Security Disability is based on your ability to work any job, you can qualify for FERS Disability Retirement if you cannot perform your current, specific job.

For example, if a law enforcement officer needs to start taking anti-anxiety medication and therefore cannot carry a gun, they would not be able to perform their job functions and could qualify for FERS Disability Retirement even though they may not qualify for Social Security Disability.

Disability Retirement Eligibility

To be eligible for disability retirement, you must meet all of the following conditions:

- Completed at least 18 months of federal service

- Not eligible for full immediate retirement

- Have become disabled while employed in federal service

- The disability is expected to last at least one year.

- Your agency cannot accommodate your medical condition, nor can they reassign you to a vacant position in the same agency at the same pay level.

- You applied for disability retirement before separating from federal service or within one year of separation.

- You applied for social security disability benefits (but are not required to qualify)

- Depending on your medical condition, medical information may be required periodically to continue receiving benefits.

Suppose you have already retired under early retirement or deferred retirement but wish to change your retirement to disability retirement. In that case, you may do that if you and your agency can submit evidence that you became disabled while in federal service and that you did not decline a reassignment to a vacant position. If you change to disability retirement, you will lose your special retirement supplement.

In addition, your disability retirement benefits will stop if you are under age 60 and:

- You have recovered from your medical condition

- Your income is at least 80% of the current rate of pay for the position you retired from

- You are reemployed in federal service in a position equivalent to the one you retired from

Disability Retirement Annuities

Disability retirement benefits are computed in different ways depending on your age and years of service. For the first 12 months, your monthly annuity is calculated as 60% of your earned annuity minus 100% of your social security benefit for any month in which you are entitled to social security disability benefits.

After the first 12 months, your monthly annuity is recalculated, and you will receive 40% of your “high-3” average salary minus 60% of your social security benefit for any month in which you are entitled to social security disability benefits.

Under Disability Retirement, you are still earning creditable years toward retirement. That means that when you turn 62, your monthly annuity is recalculated based on your new years of service, and you’ll receive your full monthly annuity. A United Benefits Retirement Specialist can help you make the calculations related to your specific situation.

Exploring Your Options

Different rules apply to CSRS and Special Provisions like CBPO. If you need or want to leave federal service before you reach full retirement age, a United Benefits Specialist can help you explore the different types of non-full retirement to maximize your retirement benefits. Use the form below to get in touch.