The G Fund is a popular TSP option since it’s a protected account, but there’s an alternative that offers good returns as well.

A protected account is an investment account that can grow but cannot lose money. The G Fund (the G stands for Government Securities) is the only account in the TSP that is a protected account. It’s a popular choice since your money is safe from market downturns. These are worry-free investments, but they still come with an opportunity cost – the G Fund annual average growth over the last 10 years was only 1.94%. Yes, your money is protected but you’re missing out on much better returns. Thankfully, there’s an alternative to the G Fund that offers both good returns and protection from market downturns.

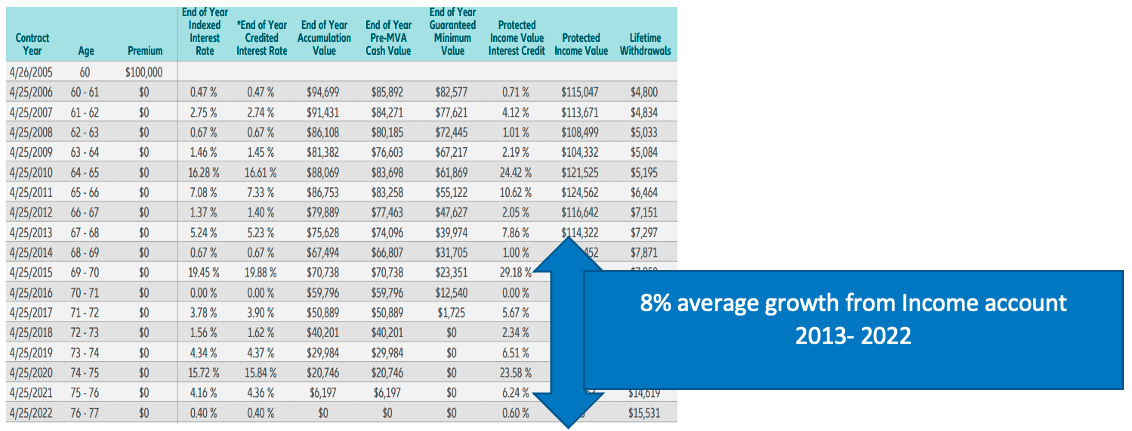

Our Guaranteed Lifetime individual retirement account (IRA) offers the safety of the G Fund with the potential for higher returns. It’s like the G Fund on steroids. No one knows exactly how the markets will perform in the future – whether it’s the G Fund or an outside IRA. However, we can forecast hypothetical performance based on past data. A hypothetical forecast for a Guaranteed Lifetime Income IRA shows the average annual growth was 8% over the last 10 years.

If you are wanting a safe place to invest your money, a protected account is a great option – and if you want a safe place with the potential of better returns, then the Guaranteed Lifetime Income IRA funds are a smart choice.

Be aware that money from your TSP can only be moved to an outside IRA when you are 59.5 years old or older while working or at any age when you retire or leave federal service. You can also roll or transfer any other at-risk investments you have outside of the TSP into a protected account on steroids.

Our United Benefits Retirement Specialists can run a worry-free hypothetical estimate for you based on your specific scenario. We think you will be pleasantly surprised with the potential for future growth. Use the form below to get in touch with us and review your options for your TSP.