Understanding Congress’s 2025 Proposals Congress has passed a budget resolution directing the House Oversight and Government Reform Committee to cut $50 billion in mandatory spending. Then, on April 30, 2025, the committee advanced a legislative package...

Understanding Congress’s 2025 Proposals Congress has passed a budget resolution directing the House Oversight and Government Reform Committee to cut $50 billion in mandatory spending. Then, on April 30, 2025, the committee advanced a legislative package...

What Is a Special Enrollment Period? Normally, you can only make changes to your health insurance coverage during specific times of the year or after experiencing a significant life event. Unless you qualify for a Special Enrollment Period (SEP), changes to your...

What Is a Special Enrollment Period? Normally, you can only make changes to your health insurance coverage during specific times of the year or after experiencing a significant life event. Unless you qualify for a Special Enrollment Period (SEP), changes to your...

As we enter 2025, there are several significant tax law changes that will impact individuals employed by the United States federal government. These adjustments could affect your paycheck, deductions, and overall tax planning, so it’s important to stay informed....

As we enter 2025, there are several significant tax law changes that will impact individuals employed by the United States federal government. These adjustments could affect your paycheck, deductions, and overall tax planning, so it’s important to stay informed....

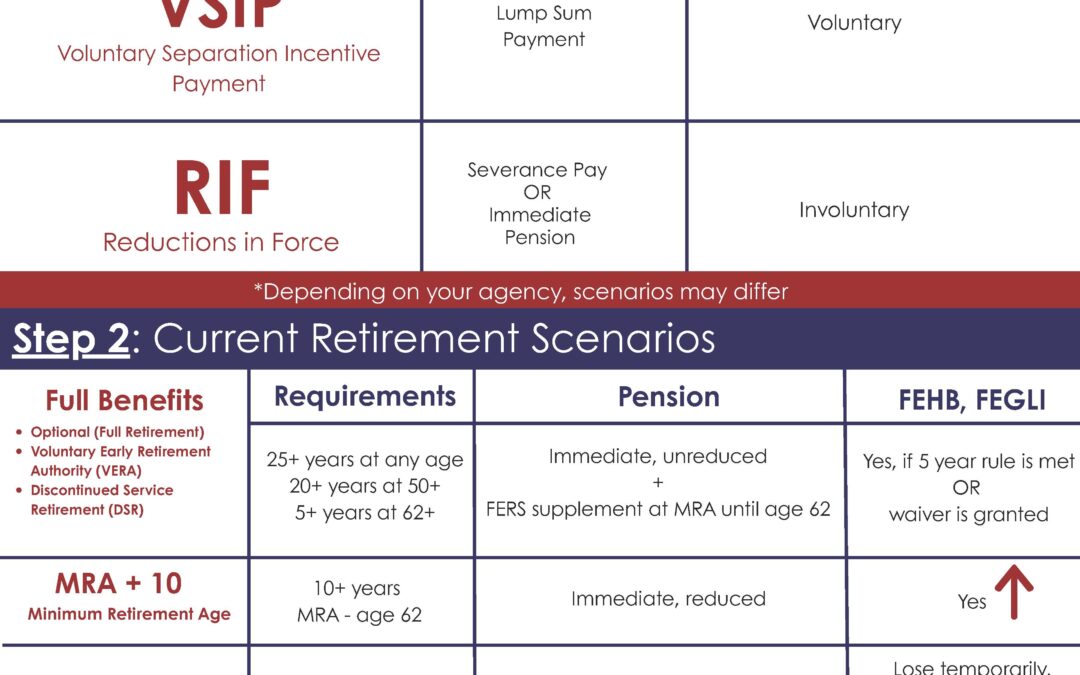

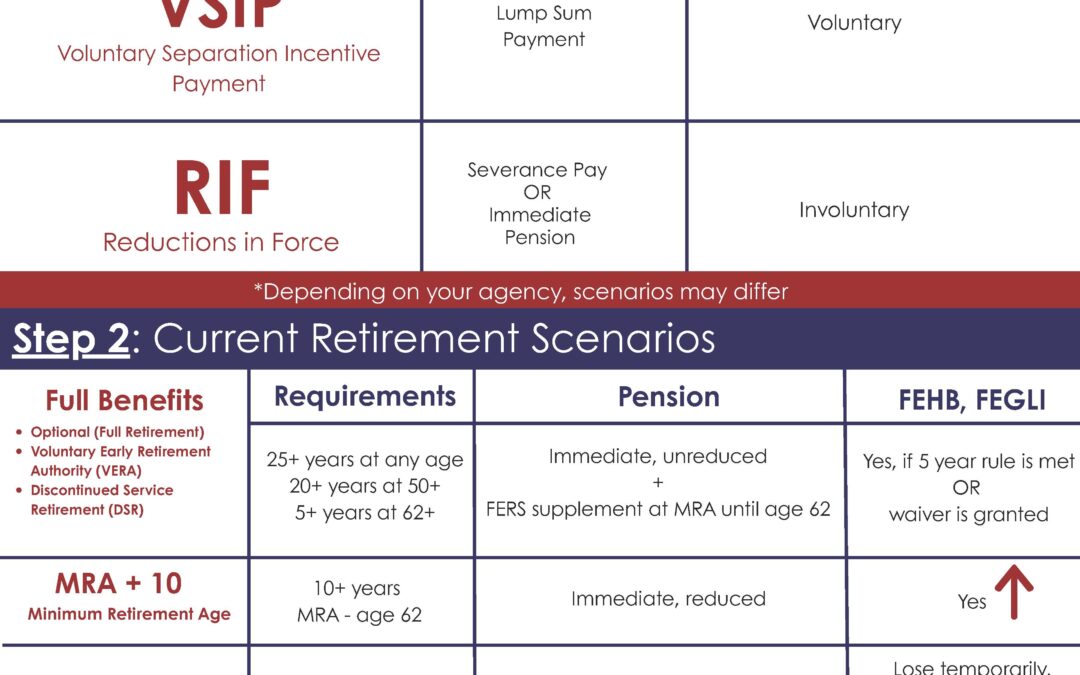

STEP 1: Determine Your Retirement Eligibility What is your Current Age and how many Years of Creditable Federal Service? (Check your Service Computation Date or SCD on your Earnings & Leave Statement) Start at the top of “Requirements” and find your...

STEP 1: Determine Your Retirement Eligibility What is your Current Age and how many Years of Creditable Federal Service? (Check your Service Computation Date or SCD on your Earnings & Leave Statement) Start at the top of “Requirements” and find your...

We’re answering your questions. This FAQ is built from the questions you’ve asked us – and we’re updating it regularly to keep it helpful and relevant. Still have a question? Use the form below and we’ll do our best to get it added! I...

We’re answering your questions. This FAQ is built from the questions you’ve asked us – and we’re updating it regularly to keep it helpful and relevant. Still have a question? Use the form below and we’ll do our best to get it added! I...