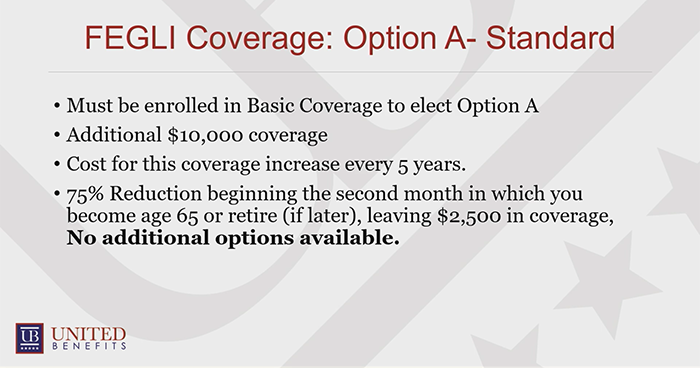

Eligible new employees are automatically enrolled in FEGLI Basic unless they waive the coverage. If you’re enrolled in Basic Coverage, you may have elected for Option A – also known as the Standard FEGLI option.

FEGLI Option A is the cheapest life insurance option available to you. It’s an additional $10,000 in coverage, for which the cost increases every five years.

When you turn 65 or retire (whichever comes later), your life insurance becomes free…but at that time your coverage will gradually drop by 75% over a 50-month period. In the end, you’ll only be left with a quarter of your original coverage.

Unfortunately, unlike other options, you can’t select a different reduction plan with FEGLI Option A. It will be reduced down to $2,500 in coverage at retirement or age 65, period.

AN EXAMPLE OF FEGLI OPTION A

Let’s say you’re a 45-year-old federal employee with an annual income of $84,500, and a plan to retire at age 60. Your BIA and coverage will be $87,000 while you’re working.

If you retire before age 65 as planned, your coverage and its cost will remain the same. But once you turn sixty-five and it becomes free, your coverage will decline over fifty months to a mere $21,750.

A quarter of your current life insurance might be all you need after retirement. But then again…it might not be.

If you think you’ll need more than a mere 25% of your current coverage in your future retirement, it’s best to act early.

If you take the initiative while you’re young, you can increase your present coverage, keep enough life insurance for your retirement, and save thousands of dollars over time.

Don’t procrastinate when it comes to finding a better life insurance option. Once you’re retired, it will be harder – and will cost more – to get coverage.

You need to find a supplemental partner who knows how FEGLI works, and who can offer life insurance plans with coverage and rates that will be beneficial to you.

Do you know if you’ll have enough life insurance after you retire?

Let’s say you’re age 45 and paying for $87,000 worth of coverage.

If you select a policy with United Benefits in the present for that same amount of life insurance, the price and coverage with United Benefits will be locked in and never change – not even after you retire or turn 65, which is when FEGLI costs would otherwise skyrocket for you.

While you’re working, United Benefits can double your coverage and then when you retire, you’ll have paid 70% less and will still maintain $87,000 in coverage– that’s a savings of over $18,000!

United Benefits has assisted thousands of federal employees on several impactful topics. We can help you, too. Ask us anything!

Click here to request a consultation and talk one-on-one with a representative about the options available to you.