What is IRMAA?

IRMAA stands for income-related monthly adjustment amount. An IRMAA is applied to a Medicare beneficiary’s Part B and D premiums based on their modified adjusted gross income (MAGI) from their income tax return of the previous two years. If a beneficiary’s MAGI is above a particular threshold, they will be subjected to IRMAA.

IRMAA was first enacted in 2003 as part of the Medicare Modernization Act. As part of that Act, IRMAA was only applied to Part B premiums. As part of the Affordable Care Act in 2011, IRMAA was extended to Part D as well.

Some Medicare beneficiaries, particularly those enrolled in Medicare Part B (outpatient or doctor visit coverage) and/or Medicare Part D (prescription drug coverage), might be confused if their monthly payments seem a bit higher than they had originally expected because of IRMAA.

How is IRMAA Calculated?

IRMAA is calculated based on your MAGI from two years prior. MAGI is your adjusted gross income (AGI) with some costs added back to it. AGI is your total income for a given year with certain deductions subtracted. MAGI adjusts the AGI by adding some of the deductions back in. In some cases, your MAGI may be the same as your AGI and in others, it may actually be more. Some deductions that can be added back into your AGI are passive income losses, IRA contributions, student loan interest, and taxable social security payments.

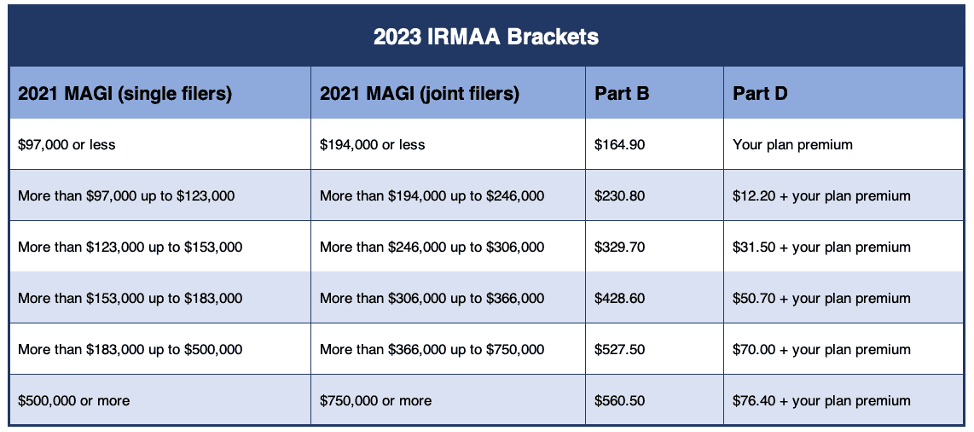

Below is a chart for the threshold tiers for 2023:

Can IRMAA be Appealed?

Yes, you can appeal your IRMAA If you think it has been calculated incorrectly or is too high. You can also appeal to specific life events.

If you believe that there is an error on your initial IRMAA notice, you may appeal by completing a “Request for Reconsideration” form (Form SSA-561-U2). This can be found on Social Security’s website or by calling your local social security office. This form will allow social security to reconsider the IRMAA amount and will reissue a new determination. If the new determination is in your favor, your IRMAA will be adjusted.

If your initial IRMAA determination is correct, but you have had a life change that significantly changes your income, you can request that your IRMAA is reduced by completing form SSA-44. This is the most common form used for IRMAA adjustments, particularly when someone is retiring from a high-income job. Form SSA-44 can be found on social security’s website or by calling your local social security office. Some common life-changing events that can impact IRMAA are marriage, divorce, the death of a spouse, or loss of income or income reductions.

Have Questions About Medicare?

A United Benefits Medicare Specialist can help you will all aspects of Medicare, including Medicare Part A, Medicare Part B, Medicare Part D, and Medicare Advantage. Use the form below to schedule a free one-on-one review of your healthcare benefits.