Whenever retirement in the United States is discussed in any capacity, even by non-federal employees, Social Security always comes up. Many people have arranged their retirement plans with Social Security assumed as part of it…but many times they are unaware of what Social Security will actually look like and how it works.

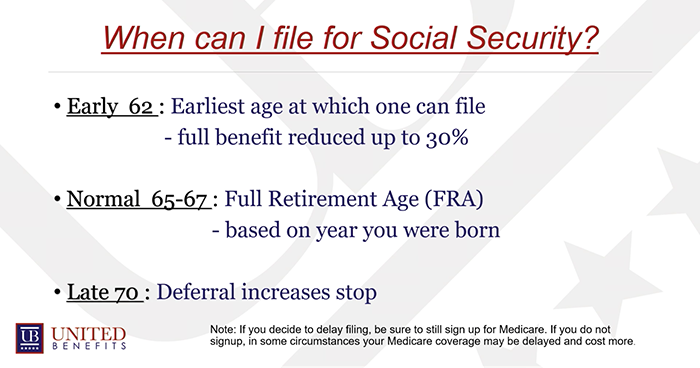

1. WHEN CAN I FILE FOR SOCIAL SECURITY?

This is, understandably, one of the first major questions that people have about Social Security.

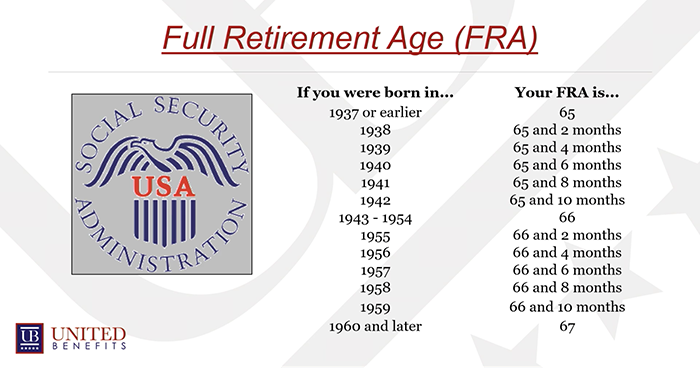

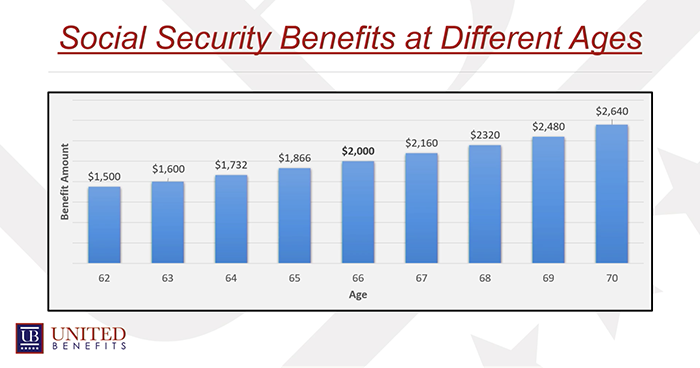

Widows and widowers are able to draw Social Security at the age of 60– otherwise, under normal circumstances, the earliest age you could draw from it is 62. However, if you file at 62 and have not yet reached your FRA, or Full Retirement Age (which is determined by the year you were born), then your full benefit may be reduced by up to 30% (we’ll go into more detail on that in the next section).

Once you do reach your Full Retirement Age, you’ll be eligible to receive your full Social Security Benefits: this is usually between the ages of 65 and 67 for most federal employees. For example, if you were born between 1943 and 1954, your Full Retirement Age is 66. If you were born after 1960, your FRA is 67.

The latest time that you can get your largest earnings from Social Security is the age of 70.

2. HOW WOULD FILING EARLY FOR SOCIAL SECURITY AFFECT MY BENEFITS?

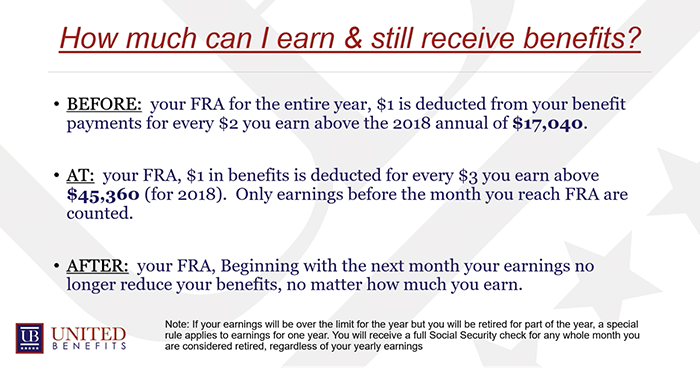

It’s important to understand the cost of filing for Social Security early, before you reach your Full Retirement Age. If you do so, you’ll be penalized for earning any money above a certain amount: as of 2018, that amount was $17,040. If you earn anything above that amount, your benefit will be reduced by $1 for every $2 you earn above the limit.

Then, during the year where you’re going to reach your FRA, that amount will change. For every $3 you earn above the $45,360 limit, they’ll take away $1. But that only happens in the months before your birthday.

The first month after you reach your Full Retirement Age, your earnings will no longer reduce your benefits from Social Security anymore. Now you can have an outside job and earn as much money as you want without being penalized.

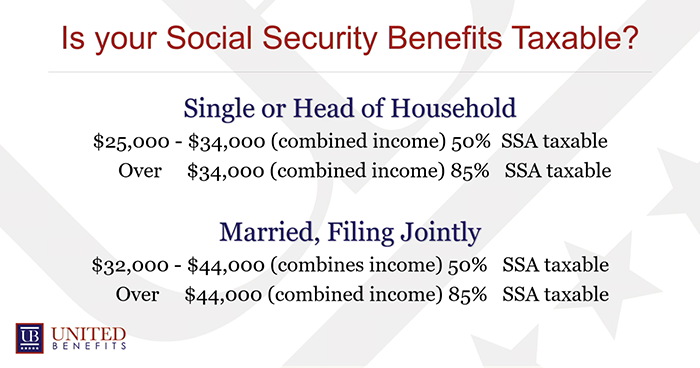

3. IS MY SOCIAL SECURITY TAXABLE?

Many people wonder if the federal government can tax their social security income– and the answer is yes, they can. If you are a qualifying widow or widower, file as single, or are the head of the household, half of your benefits will be taxable if you make between $25,000 and $34,000 a year. If you’re making over $34,000, then 85% of your Social Security will be taxable.

If you are married and file jointly, half of your Social Security will be taxable if you make $32,000 to $44,000 a year. If you’re earning over $44,000, 85% of your benefits will be taxable.

4. WHAT’S THE MAXIMUM ANYONE CAN EARN ON SOCIAL SECURITY?

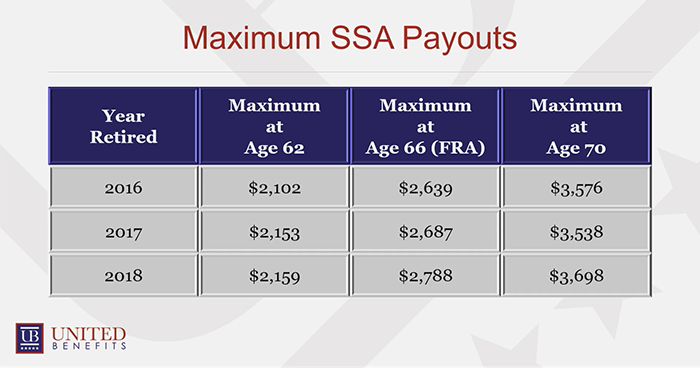

Most people don’t know that Social Security has a maximum payable amount you are eligible to receive: you can look at it as a cap. That amount can change each year. Below you will find a chart with the maximum Social Security payouts someone could receive – both before and after reaching their Full Retirement Age.

As of 2018, the maximum payout someone could receive was $3,698 per month – if they had waited until they were 70 years old to file. However, if they’d filed early at age 62 before hitting their FRA, the most they could receive is $2,159 monthly.

5. WHAT SOCIAL SECURITY STRATEGY IS RIGHT FOR ME?

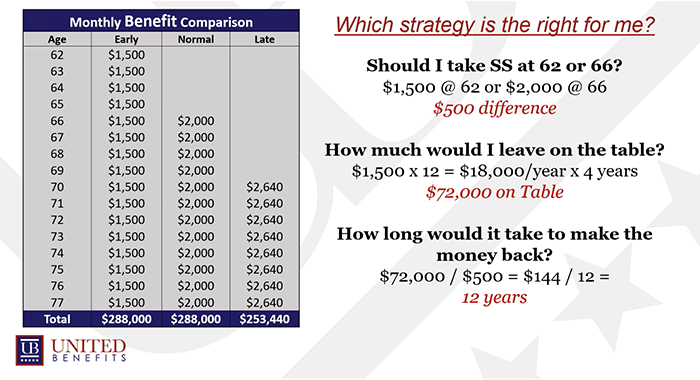

So, given the effects of your income and your age on your Social Security Benefits, at what age should you file for Social Security? Should you file at age 62, or at your FRA which could be, say age 66?

At 62, let’s say you’ll receive $1,500 a month from Social Security. If you wait until your FRA at, say 66, you can make $2,000. There’s a $500 difference in benefits between those two ages.

Exactly how much money would you miss out on if you wait until age 66, and don’t file at age 62?

Take that $1,500 per month, which adds up to $18,000 per year, and multiply it by the four years between ages 62 and 66: that’s $72,000 that you won’t receive if you wait to file until reaching your Full Retirement Age.

But you also need to remember: if you file early for social security, even though the penalizations will stop once you reach your FRA, you still won’t be earning as much month to month as somebody who waited until age 66 or age 70. After 12 years of receiving their benefits, they will have earned back that $72,000 that you got early– and after that, their benefits will only increase in comparison to yours.

This is why it’s important for you to sit down with somebody one-on-one and map this out. Ask yourself, “How long do people in my family live? And will I live to that age?”

These aren’t easy questions to think through– but it’s important to plan ahead. Fortunately, you don’t have to do any of this alone.

ARE YOU CONFIDENT IN YOUR PLANS TO MAXIMIZE YOUR SOCIAL SECURITY?

United Benefits has assisted thousands of federal employees on several impactful topics. We can help you, too. Ask us anything!

Click here to request a consultation and talk one-on-one with a representative about the options available to you.