LEAVING FEDERAL SERVICE?

Quick Links

We’re Here to Support YOU

Regardless if You Leave Federal Service or Not

The choices you make about your benefits during transition can have long-lasting impacts. For personalized guidance based on your specific situation contact us for a free one-on-one benefits review.

Leaving Federal Service?

Understanding Your Benefits

Whether through deferred resignation, retirement, or other separation, managing your transition requires careful benefits planning. Here’s where we can help:

-

Understand the full impact on your benefits

-

Compare your current benefits with available options after you leave service

-

Find coverage options for you and your family

-

Maximize your federal benefits

ESTIMATE YOUR SEVERANCE PAY

The Federal Severance Pay Calculator is based on the U.S. Office of Personal Management calculation of severance pay. To estimate your potential severance pay, simply enter your annual basic pay, years of service, and date of birth in the calculator below. The tool will automatically estimate your total severance pay, biweekly payments, and the duration of your severance period. Some employees may not be eligible for severance pay. If you have 25 or more years of service or if you are over the age of 50 and have 20 or more years of service, please contact your agency to determine your eligibility in accordance with OPM Policy and Agency Agreements.

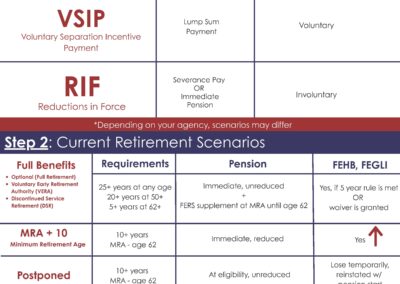

DFP, VSIP, & RIF PROGRAMS

Updated April 2025

FAQ about the Deferred Resignation Program, Voluntary Separation Incentive Payments, & Reduction in Force

Need Help with This Chart?

Click here for a blog to show you how to use the chart!

KEY BENEFIT AREAS

Some questions to consider as you plan your transition.

HEALTH INSURANCE (FEHB)

Your health coverage decisions during transition are critical for ensuring continuous care for you and your family.

- What happens to your FEHB coverage after separation?

- Do you qualify for temporary continuation of coverage (TCC)?

- Understanding your enrollment windows for alternative coverage

- Options for maintaining coverage in retirement

LIFE INSURANCE (FEGLI)

Your life insurance coverage is a crucial part of your family’s long-term security plan.

- Understanding what happens to your FEGLI coverage after separation

- How FEGLI works in retirement

- Timeline for making FEGLI conversion decisions

- Exploring alternative life insurance solutions that can move with you

- Evaluating coverage amounts based on your new circumstances

THRIFT SAVINGS PLAN (TSP)

Your retirement savings require careful consideration to protect and optimize your long-term financial security:

- What are your TSP options after leaving federal service?

- Understanding withdrawal choices and timing

- Rolling over your TSP to other retirement accounts

LEAVE & PAY CONSIDERATIONS

Understanding how your accumulated leave and final compensation will be handled helps you plan your transition effectively.

- Annual leave payout calculations

- Sick leave implications

- Final paycheck timing

- Understanding your last day benefits

Relevant Blog Posts

Government Shutdown FAQ

We're answering your questions. This FAQ is built from OPM's Guidance for Shutdown Furloughs as well as the questions you've asked us. ... read more

Understanding the Medicare Extra Help Program for Part D

The Medicare Extra Help program was created to assist beneficiaries with the costs associated with prescription drug coverage, ... read more

Understanding Affordable Care Act Subsidies and How They Work

The Affordable Care Act (ACA) was established to provide access to healthcare for all individuals and to ensure that every plan covers ... read more

The Importance of Preventative Care

The Importance of Preventative Care Most people only visit the doctor when they’re sick or injured, but preventative care is key to ... read more

Proposed Federal Benefits Cuts: Understanding Congress’s 2025 Proposals

Understanding Congress’s 2025 Proposals Congress has passed a budget resolution directing the House Oversight and Government ... read more

What Is a Special Enrollment Period?

What Is a Special Enrollment Period? Normally, you can only make changes to your health insurance coverage during specific times of the read more

DRP, VSIP, RIF & Current Retirement Scenarios Chart

STEP 1: Determine Your Retirement Eligibility What is your Current Age and how many Years of Creditable Federal Service? (Check your ... read more

Leaving Federal Service FAQ

We're answering your questions. This FAQ is built from the questions you've asked us - and we're updating it regularly to keep it ... read more

Comparing Medicare Supplement Plans

Medicare Supplement Insurance plans, also known as Medigap plans, are designed to fill the “gaps” left behind by Original ... read more

Navigating a Reduction in Force (RIF): What Federal Employees Need to Know

In the Federal Government, layoffs are called reduction in force (RIF) actions. When an agency must abolish positions, the RIF ... read more

5 Things Every Federal Employee Should Know Before Separating from Service

Whether you accepted the deferred resignation offer, retire from federal service, or your position is ultimately eliminated, there are ... read more

What are VERA & VSIP?

What is VERA? VERA, often called an “early out,” stands for Voluntary Early Retirement Authority and allows eligible FERS ... read more

Health Share Programs

Exploring Health Share Programs as a Cost-Saving Alternative Health insurance can be confusing and expensive. If you’re one of the many read more

TSP vs. IRA: What Federal Employees Need to Know

Recent changes in federal employment have many wondering about their TSP. While the TSP offers low fees and agency matching, is that ... read more

What Could Change with the TSP?

What could change with the TSP under this administration? The President of the United States can influence changes to the Thrift ... read more

Interim Pay Status: Are you prepared to go months in retirement without full pay?

Are you prepared to go months in retirement without full pay? Processing your annuity cannot begin until after your date of separation ... read more

FEGLI: Understanding the Costs and Coverage Changes

1. Cost Increases Dramatically Over Time One of the most significant drawbacks of FEGLI is the escalating cost. As you age, premiums ... read more

FEHB & Retirement

If you meet the retirement or separation from service requirements and have maintained your FEHB for five years, you will be eligible ... read more

FEHB & Medicare

What are my options for coordinating FEHB and Medicare in retirement? There are three primary options for coordinating your FEHB ... read more

What is Military Buyback?

What is Military Buyback? Military buyback allows federal civilian employees who have served in the military to “buy back” ... read more

Fork in the Road Update: Early Retirement Now Available for Eligible Employees

The Office of Personnel Management has updated its FAQ section about the “Fork in the Road” Deferred resignation offer to ... read more

Medical Expenses and Retirement Planning

Retirement planning is a complex process, and everyone’s financial goals are different. There is no “one-size-fits-all” solution. One ... read more

HSAs and Tax Savings

Setting aside money in a Health Savings Account (HSA) can help you financially prepare for medical expenses while also taking advantage read more

FEHB Open Season FAQs: What You Need to Know

Open Season for the Federal Employees Health Benefits (FEHB) program an important time for governmental employees. To help you navigate read more

2024 Open Season

Key Dates for FEHB and PSHB Open Season The Federal Employees Health Benefits (FEHB) and Postal Service Health Benefits (PSHB) open ... read more

How to Appeal Your Part B Premium

Not everyone has the same premium for their Medicare Part B Insurance. The Centers for Medicare and Medicaid Services (CMS) sets a ... read more

Medicare Advantage Misinformation – Get the Facts

Medicare Advantage is a topic rife with misinformation and misconceptions. Some of this misinformation is fueled by political agendas, ... read more

FEHB and Improved Fertility Coverage

In early 2023, the Office of Personnel Management (OPM) addressed the need for better fertility treatment options within the Federal ... read more

Understanding the Postal Service Reform Act of 2022 and Its Impact on Health Benefits

In April 2022, the Postal Service Reform Act of 2022 (PSRA) was enacted, marking the start of a collaborative effort between the Office read more

Thrift Savings Plan: Mid-Year Update

From benchmark index updates to enhanced withdrawal flexibility, here’s what you need to know about changes to the Thrift Savings Plan ... read more

Should I Be Contributing to the ROTH TSP?

Some of the most common questions about the Thrift Savings Plan involve the ROTH option. Federal employees want to know if it could be ... read more

How to Stop Unsolicited Medicare Calls

Receiving unsolicited calls about Medicare can become overwhelming as you near 65, with some people reporting up to 50 calls a day. ... read more

What Do I Do if a Federal Employee Dies?

Whether you are preparing for the future or if your loved one was a federal employee, it can be difficult to sort through the various ... read more

What are my options if I missed FEHB open season?

If you missed the FEHB open season, there’s no need to worry. You still have options to adjust your healthcare coverage. You can ... read more

How to Become a Millionaire with Your TSP

Becoming a millionaire may seem like a daunting task, but with careful planning and a long-term perspective, it is possible to reach ... read more

Planning Ahead for Long-Term Care After Age 65

After the age of 65, long-term care planning becomes a cornerstone of maintaining your quality of life and independence. As you age, ... read more

Planning Ahead for Long-Term Care in Your Mid-50s & Early 60s

The Need for a Solid Plan As you approach your mid-50s to early 60s, it’s crucial to plan for long-term care. This is the time to read more

Planning Ahead for Long-Term Care Before Age 50

Early Planning: A Wise Choice Looking at long-term care planning before you turn 50 is a proactive step that can significantly ease ... read more

Selecting a Federal Dental Plan

Federal Dental Plans 101 Federal dental plans can be added, dropped or changed during each annual enrollment period. Federal ... read more

2024 Brings New Medicare Part D Options for FEHB Plan Members

In a significant update for 2024, the Office of Personnel Management (OPM) has enhanced the Federal Employees Health Benefits (FEHB) ... read more

Expanded Access to VA Benefits for All World War II Veterans

The Department of Veterans Affairs has recently made a landmark announcement: every World War II veteran is now entitled to ... read more

Understanding the SECURE 2.0 Act and Its Impact on the Thrift Savings Plan

Navigating the changes in the Thrift Savings Plan (TSP) brought about by the SECURE 2.0 Act might seem complex, but with the right ... read more

5 Common Life Insurance Myths

While the importance of having a life insurance policy may seem obvious, there are several common life insurance myths that keep people read more

Why Do You Need Life Insurance During a Recession?

Why Do You Need Life Insurance During a Recession? Times are tight right now. Although it’s tempting to cancel your life insurance ... read more

VA Medical Benefits, TriCare, and Medicare Explained

If you are a veteran, you may have access to VA Medical Benefits or Tricare, depending on the duration of your military service. ... read more

5 Ways to Save Money on Prescription Costs

Understanding How Your Insurance Covers Prescription Drugs Whether you have your health insurance through FEHB, Tricare, Medicare, ... read more

Understanding How IRMAAs Impact Medicare

What is IRMAA? IRMAA stands for income-related monthly adjustment amount. An IRMAA is applied to a Medicare beneficiary’s Part B and D ... read more

What Do I Do After a Federal Employee Dies?

The passing of a loved one is a difficult time, and the process of dealing with the aftermath can be overwhelming. If you’re the ... read more

How to Prepare for Long-term Care: What Are My Options?

Preparing for long-term care expenses is an important part of your retirement planning process. It’s not an enjoyable topic to ... read more

How the BENES Act Impacts Medicare

What is the BENES Act? The Beneficiary Enrollment Notification and Eligibility Simplification Act, also known as the BENES Act, was ... read more

How do I enroll in Medicare?

Applying for Medicare can be confusing depending on your specific situation. It is important to know how to apply based on the timing ... read more

Post-Retirement: Final Destination

You did it! You completed your federal career and have transitioned into retirement. A hearty congratulations are in order. You worked ... read more

Pre-Retirement: Are We There Yet?

Determining Retirement Qualifications Monthly Annuity Pension Your FERS or CSRS monthly annuity is also referred to as your pension. ... read more

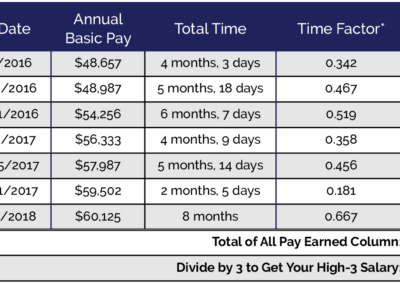

Calculating Your High-3 Salary

When determining your FERS pension, you will need to calculate your High-3 Salary is a very important part of your FERS pension ... read more

Why Should I Replace My Federal Employee Group Life Insurance (FEGLI)?

Having life insurance coverage is one of the most important ways you can protect your family from financial burdens. With life ... read more

How to Navigate Benefits in Your New Career

From Hired to Retired: Your Federal Career Roadmap How to Navigate Benefits in Your New Career When you begin a new career, you have ... read more

Babe Ruth, The Great Depression, and Annuities

Content adapted from material by Soeren Svendsen Annuity Reserve. What do annuities have to do with the greatest major league baseball ... read more

How does the RMD affect leaving my TSP balance to my beneficiaries?

If your goal is to leave your TSP balance to your beneficiaries after you pass away you may be wondering how the Required Minimum ... read more

Medicare 101

Medicare 101: The Basics Regardless of your Federal Employees’ Health Benefits (FEHB) or Medicare plans, it is important to understand ... read more

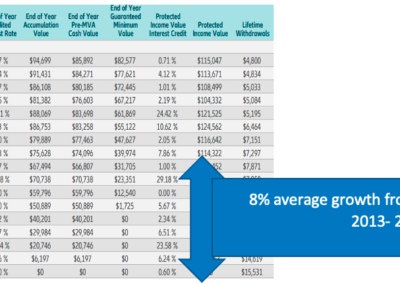

What’s a Safe Alternative to the TSP G Fund?

The G Fund is a popular TSP option since it’s a protected account, but there’s an alternative that offers good returns as ... read more

Should I use TSP Funds to pay off my home?

Paying off a home is something we all strive to do; however, is it worth it to use funds from your Thrift Savings Plan (TSP)? The short read more

How Does Inflation Impact Life Insurance?

Inflation has been a hot topic lately. One of the most important economic indicators is how the prices of goods and services change ... read more

The Five Biggest Myths about Federal Retirement

The retirement process may be one of the most confusing aspects of federal employment. Here are some common myths regarding federal ... read more

Using the GRB Platform to Complete Your Retirement Process

If you’re planning to retire from federal service soon, the Government Retirement and Benefits (GRB) Platform is a great tool that may ... read more

What Happens If I Retire Early?

Early Retirement, Deferred Retirement, Postponed Retirement, and Disability Retirement Life happens – maybe you intended to be a ... read more

Legacy Planning: The Fifth Piece of the Retirement Puzzle

As a Federal Employee you have earned and created many benefits. If or when you pass away some of the benefits are designed to take ... read more

FEHB & Medicare: The Fourth Piece of the Retirement Benefit Puzzle

FEHB & Medicare Federal Employee Health Benefits (FEHB) and Medicare work together to form a crucial piece of your retirement ... read more

Thrift Savings Plan: The Third Piece in the Retirement Benefits Puzzle

Your Thrift Savings Plan (TSP) will generally be used as a third source of income after Social Security and your pension. The TSP has ... read more

Understanding Social Security for Federal Employees: The Second Piece of the Retirement Puzzle

Social Security is a fundamental piece of your retirement income puzzle. It is a guaranteed lifetime payment, and one of three payments read more

FERS & CSRS Monthly Annuities: The First Puzzle Piece of the Retirement Benefits Puzzle

Monthly Annuities Your pension, also called a monthly annuity, is the fundamental basis for your overall retirement income. Most ... read more

The Retirement Benefits Puzzle

We all look forward to our retirement, but as we approach our last day of work anxiety kicks in. Can I afford to retire? How much money read more

How Thrift Savings Plan Matching Works

Are you taking advantage of Thrift Savings Plan matching? For FERS employees, the matching inside the Thrift Savings Plan is the ... read more

What is the difference between Traditional TSP & ROTH TSP?

Although the ROTH option has been available in the Thrift Savings Plan since 2012, I’ve found that most federal employees do not read more

Understanding the Basics of Whole Life Insurance

When it comes to protecting your family with life insurance, many people turn to Whole Life policies for their unique features such as ... read more

5 Things To Consider Before Retiring From Federal Service

There are many factors related to retiring from federal service, and it is never too early to start planning. But where do you begin? ... read more

FEHB Checklist for Open Season

By: Ryan Boggus Choosing your health care plan can be a confusing, overwhelming decision. It can be tempting to entirely skip ... read more

Did You Know Your FERS/CSRS Annuity Won’t Automatically Go To Your Family?

Blog Created By: Brandon Bradley Did you know your FERS/CSRS Annuity won’t automatically go to your family? Plan early or pay ... read more

Have You Designated Beneficiaries For Your Federal Benefits?

Who Will Inherit Your Legacy? Having a will or trust does not guarantee that your beneficiaries will inherit what you ... read more

I Have Health Insurance Through the Government. Why Should I Have a Hospital Indemnity Plan?

(more…) read more

Why is Short Term Disability Important for a Federal Employee?

Why is short-term disability so important for a federal employee? Most everyone has heard that it is a good idea to have a short-term ... read more

Will You Have Enough Income in Retirement?

The number one fear of retirees is running out of money- either out living their assets or not having enough income to keep up with ... read more

What are the Main Principles of TSP?

When it comes to saving for retirement as a federal employee, one of the options at your disposal with the widest variety your TSP, or ... read more

Planning and Budgeting for Retirement

DO YOU HAVE A WRITTEN BUDGET AND A PLAN!? As a federal employee preparing for retirement, there are several things that you need to be ... read more

What is Life Insurance and How Does It Protect Myself and My Family?

What is Life Insurance? Life Insurance is an insurance policy. in You pay a small premium amount at a certain frequency and in return ... read more

When Can I File for Social Security, and How Much Will I Receive?

Whenever retirement in the United States is discussed in any capacity, even by non-federal employees, Social Security always ... read more

Calculating Your FEGLI Rates & Benefits

The cost of your Federal Employee Group Life Insurance and the amount of coverage you receive from it are difficult to ... read more

What Does My Retirement Look Like Under the Civil Service Retirement System?

The Civil Service Retirement System is a defined benefit contributory pension plan. It was established August 1st, 1920, and was later ... read more

What is the FERS Survivor Annuity Plan?

Retirement under the Federal Employee Retirement System doesn’t affect government workers alone. If you’re a federal employee, you’ve ... read more

What is FERS Special Provision Retirement?

Several different government agencies are covered under Special Provision Retirement, which differs slightly from the traditional ... read more

What is the FERS Annuity Supplement?

As a FERS Federal Employee you have a three component retirement system, FERS Pension, Social Security, and Thrifts ... read more

What Does My Retirement Cost Today?

As a federal employee, you may be wondering exactly how much money is being deducted per paycheck for your retirement. First, we need ... read more

When Am I Eligible for my FERS Retirement?

This article only pertains to FERS and qualifying for full immediate retirement. Look for future blogs on special provisions and read more

Federal Employee Retirement System Overview

1. WHAT IS THE FEDERAL EMPLOYEE RETIREMENT SYSTEM? read more

What Do Thrift Savings Plans Look Like After Retirement?

We’ve been talking about the accumulation vehicle of your Thrift Savings Plan, which is one of the best out there. Once ... read more

3 Things in Your Thrift Savings Plan You Can Control

Determining the arrangements surrounding your Thrift Savings Plan is complicated– and frankly, it’s scary. Whatever choices you make ... read more

The TSP Modernization Act of 2017

A lot of people have a lot of questions about this new law: the TSP Modernization Act of 2017. The modernization act officially goes ... read more

Understanding Your Thrift Savings Plan

As a federal employee, the Thrift Savings Plan is one of the greatest ways to plan for retirement and build wealth. This blog will go ... read more

Option C with FEGLI

Eligible new employees are automatically enrolled in FEGLI Basic unless they waive the coverage. You may have enrolled in FEGLI Option ... read more

Option B with FEGLI

Eligible new employees are automatically enrolled in FEGLI Basic unless they waive the coverage. You may have enrolled in FEGLI Option ... read more

Option A with FEGLI

Eligible new employees are automatically enrolled in FEGLI Basic unless they waive the coverage. If you’re enrolled in Basic Coverage, ... read more

Basic FEGLI Benefits

Every eligible federal employee is automatically enrolled into the Basic Federal Employee Group Life Insurance, unless you waived it ... read more

Contact a United Benefits Specialist

Recent executive orders have introduced significant changes to federal employment policies, including return-to-office mandates, workforce restructuring, and deferred resignation options.

As your dedicated federal benefits specialists, we’re committed to helping you navigate these changes with confidence.

What is Deferred Resignation?

The recently announced deferred resignation program offers eligible federal employees the option to submit their resignation now while continuing to work and receive full pay and benefits through September 30, 2025. This program is part of broader federal workforce reforms announced in January 2025.

Key Features

- Submission Period: Starting January 28-February 13

- Once submitted, the resignation decision is final

- End Date: September 30, 2025 (with option to leave earlier)

- Full compensation and benefits continuation

- Exemption from new return-to-office requirements

- Option to elect retirement if eligible before resignation date

Disclosure: United Benefits does not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only. It is not intended to provide, and it should not be relied upon for tax, legal, or accounting advice. You should contact your tax, legal, and/or accounting advisor(s) before engaging in any transaction.